A/B Captive vs Quota Share: The Independent Agent's Guide to Choosing the Right Structure

June 24th, 2025

5 min read

A practical comparison to help you match the right captive model to your client's needs

The Reality Most Agents Don't Know (Because They're Not Being Told)

Here's something that might surprise you: there's an entire captive funding model that could solve your biggest client objections—and most agents have never heard of it.

Why? Because the biggest players in our industry don't use quota share captives, they don't discuss them. They stick with what they know: A/B captives. And when that's all they offer, that's all they explain.

Meanwhile, you're out there losing deals because clients balk at collateral requirements or get nervous about taking on full risk exposure. You think captives just aren't a fit when really, you're just missing half the conversation.

Here's the truth: when you're talking captives with a client, you're not just choosing whether to move forward—you're choosing which funding model gives them the best shot at success.

Most agents know about A/B captives. They've seen the presentations, heard the pitch about splitting premiums into A funds and B funds. However, here's what stops conversations cold: when that client asks about collateral requirements or what happens if they have a bad claims year right from the start.

That's where quota share captives come in. The option you're not being told about. The solution that's been sitting there the whole time.

I learned this the hard way. Three years ago, I lost a $300,000 client—not because I screwed up the service, but because someone else offered them a captive strategy and I wasn't ready. That won't happen again. And after you read this, it won't happen to you either.

Don't Turn This Into a Math Lecture

Look, most agents make the mistake of turning captives into a math lecture. Pro tip: Don't do that.

Your clients want three things: control, transparency, and stability. Once they understand that captives deliver on all three, the rest becomes easy. However, first, you need to determine which funding model best suits their situation.

Both A/B and Quota Share are GROUP captive funding options—your client joins with other like-minded businesses to share risk and pool resources. The difference lies in HOW the money flows and WHO takes the risk.

The Two Funding Models You Need to Understand

Let me break down both models in plain English, because the technical jargon doesn't help anyone close business deals.

A/B Captive: The "Bet on Yourself" Model

The A/B model is designed for businesses that want maximum control and maximum upside when they manage their risk effectively. But with that comes more responsibility.

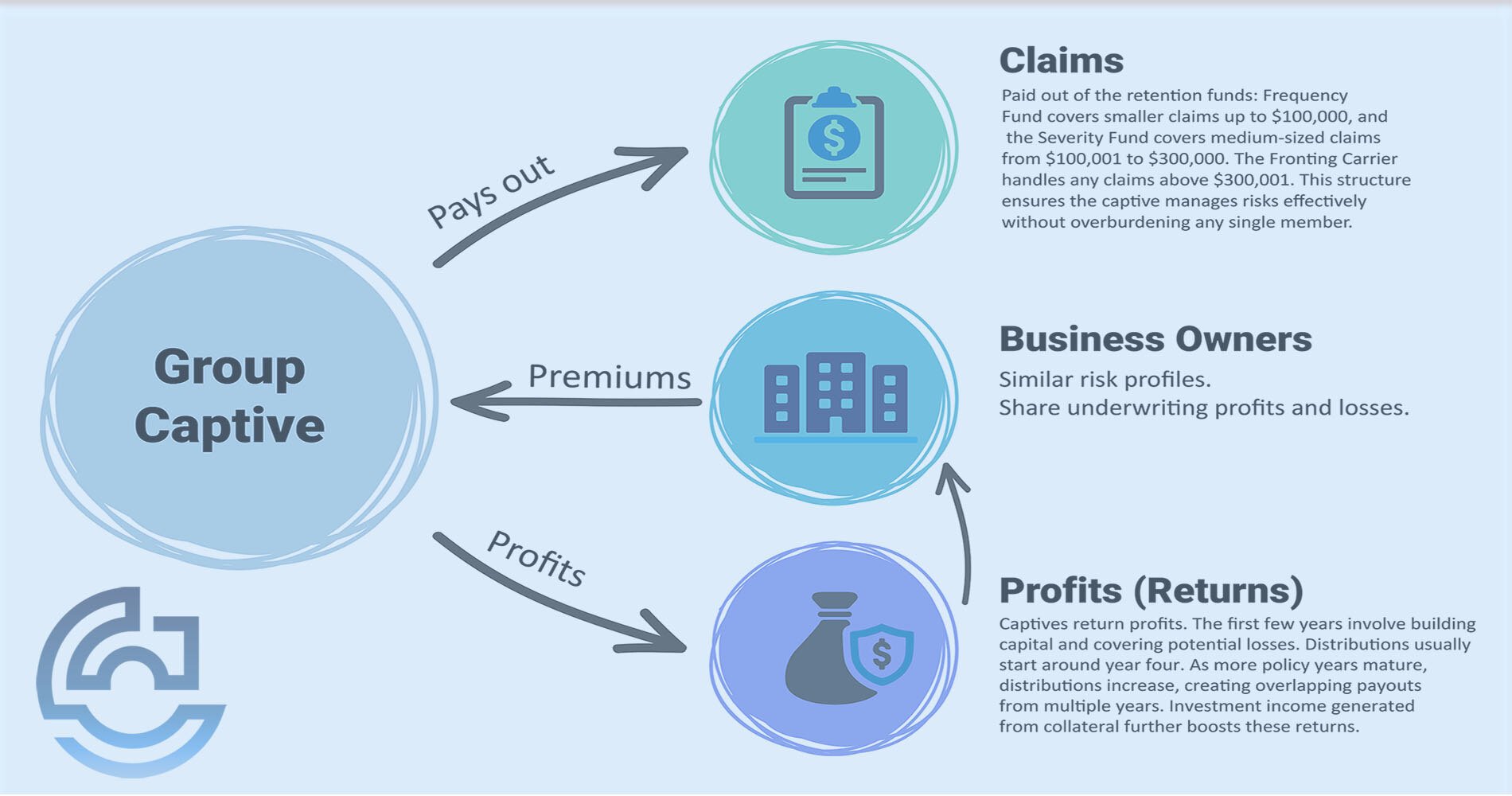

How the money works: Your client's premiums get split into three main buckets:

- Premium contribution – What they pay (same process as today)

- Captive's combined fund – Pooled with other members you know and trust

- Fronting carrier – Handles coverage above the retention layer

But here's where A/B gets unique. The loss funds get split into two separate accounts:

- A Fund (Frequency Fund) – Handles frequent, smaller claims that can be controlled through better safety programs and loss control

- B Fund (Severity Fund) – Set aside for larger, unexpected losses that sometimes just happen to good businesses

The upside: When claims are low, your client keeps 100% of the underwriting profit. No quota share partner is taking half. No reinsurers getting a cut. When they win, they win big.

The reality check: They're taking on more risks, which means higher collateral requirements. Think of it as a security deposit for owning their own insurance company—but it's also their investment that earns returns.

Best for: Companies with predictable operations, strong claims management, and the capital to support higher collateral requirements. These are your clients ready to bet on themselves.

Quota Share Captive: The "Shared Partnership" Model

Quota share is designed for businesses that want to offer captive benefits without assuming full risk exposure.

How the money works: The magic is in the four buckets working together:

- Premium contribution – What they pay (same process as today)

- Captive's combined fund – Pooled with other members

- Fronting carrier – Handles coverage above retention

- Quota share partner – A reinsurer who shares BOTH the risk AND the profit

Here's the key difference: when a claim arises, it's split between your client's captive group and the quota share partner, typically 50/50. Same split on premiums, same split on profits.

The advantage: Because risk is shared, collateral requirements drop dramatically. Remember what I said about conversations coming to a sudden halt? This fixes that problem.

The growth path: Your client can start with a quota share and eventually reduce or remove it as they become more comfortable. It's like having training wheels while learning the captive world.

Best for: Companies new to captives, those with moderate claims histories, or businesses that want captive benefits while sharing risk with professionals.

The Collateral Conversation (And Why It Matters)

Let me tell you why this matters in real client meetings.

With A/B captives, you're often looking at significant collateral requirements. When I'm talking to an agent about a $500k premium, and they realize their client might need to post $450k in collateral, that's where deals die.

With quota share? The collateral requirements are dramatically reduced because the reinsurer is sharing the risk. With the same $500k premium, the collateral in quota share is $100k. Done. You're not asking your client to bet the farm—you're asking them to partner with professionals while maintaining captive benefits.

This isn't just theory. In my calls with agents, this is the difference between "let me think about it" and "when can we start?"

What Happens When Claims Hit

In the A/B Model:

- Good year: Client keeps 100% of frequency fund savings

- Challenging year: Assessment up to predetermined cap, then risk sharing kicks in

- Major claim: B fund contributes first, then A fund if needed, then other members cover the remainder

In the Quota Share Model:

- Every claim: Automatically split with quota share partner (typically 50/50)

- Good year: Client shares underwriting profit with quota share partner

- Bad year: Quota share partner shares the pain

- Investment income: Also shared with the quota share partner

The Messaging That Actually Works

B Captive - "Bet on Yourself":

- "When you perform well, you should be the one who benefits"

- "Maximum control, maximum upside"

- "You're saying 'We run a good operation and want to keep the benefits'"

- "100% of underwriting profit when you win"

Quota Share - "Shared Partnership":

- "You're sharing risk, but you're also sharing reward"

- "Easing in without taking on too much too soon"

- "Training wheels while you learn the captive world"

- "Less money tied up, more working capital for your business"

- Members are not stuck in the QS model forever. As the captive matures, it can remove the quota share reinsurer and take on more risk and gain more reward

When to Recommend Each Model

Go with A/B Captive when your client:

- Has predictable risk profiles and strong claims management

- Wants maximum control over their insurance destiny

- Is willing to take on more risk for more reward

- Has capital to support higher collateral requirements

- Believes their risk management should directly benefit their bottom line

Go with Quota Share when your client:

- Is new to captives and wants to ease in gradually

- Has a moderate (not perfect) claims history

- Needs lower capital requirements to get started

- Wants captive benefits but shared risk

- Sees collateral as a barrier to entry

The Bottom Line for Independent Agents

Look, if you're only presenting one captive option, you're going to lose deals. Period.

Some clients are ready to bet on themselves with an A/B structure. Others need the shared partnership of quota share. The key is having both tools in your toolbox and knowing when to use each one.

Because here's what I've learned: it's not about having the "best" captive structure. It's about having the right structure for each client. And when you can offer both, you become the agent who can solve problems instead of the agent who just quotes insurance.

What This Means for Your Practice

The agents who win in captives aren't the ones who memorize presentations. They're the ones who can look at a client's specific situation and say, "Based on what you've told me, here's why this structure makes sense for you."

A/B captive for the client who is ready to own their results. Quota share for the client who wants to ease into captive ownership. Both are group captive funding models. Both deliver control, transparency, and savings. The difference is the risk-reward balance.

That's how you protect your best relationships. That's how you win new ones. And that's how you build a captive practice that actually works.

The Growth Strategy Most Agents Miss

Here's the beautiful part about understanding both models: quota share provides a clear path for you to grow with your clients.

Start a new-to-captives client with a quota share—lower capital requirements, shared risk, and learning with protection. As they become more comfortable and their risk management improves, you can have a conversation about reducing or eliminating the quota share reinsurance.

You're not just selling them insurance. You're guiding them on a journey from traditional insurance dependency to captive ownership. And you're the agent who makes that journey possible.

Ready to learn more about protecting your best clients with captive strategies? The agents who move first are the ones who keep their biggest accounts. Don't let someone else have that conversation with your client.

Warren Cleveland launched Captive Coalition after firsthand experience as an independent agency owner revealed a major gap in the market: agents lacked access to the knowledge and resources needed to compete with large brokerages offering captive insurance solutions. Warren brings over a decade of insurance leadership—including as President of ReNu Insurance Group—and a career that spans aviation, real estate, and commercial insurance. His mission is to ensure agents stay in control, keep their best clients, and confidently lead with captives. Warren Cleveland, ACI, CIC, AAI