Comparing Single-Parent, Group, and Cell Captives:

A Guide For Independent Agents

May 7th, 2025

4 min read

You might be wondering how to relay information about captive insurance to your clients. Sometimes, captives can feel like another language. The thing is, you don’t want to shy away from the conversation. You want the information you need to convey at your fingertips. After all, it makes it easier to help your clients and ensure they aren’t looking elsewhere.

Captive Coalition’s sole purpose is to help educate independent agents on all things captive insurance. We want you to know how captives work and how to talk about them so you can confidently have the conversation with your best clients.

This article will cover Single-Parent, Group, and Cell Captives, how they compare, how they fit, and how their funding structures work. That way, you can talk about captives like you’ve been doing it for years.

Why Captives? Why Now?

You know the story every renewal season. Premiums go up, even when your best clients have low losses. The traditional market squeezes clients hard. The worst part? Your clients are frustrated. The same old tired options don’t work for them anymore.

Here’s the good news: captives give your best clients what they want–control, transparency, and the potential for real savings. If you don’t bring it up, someone else will.

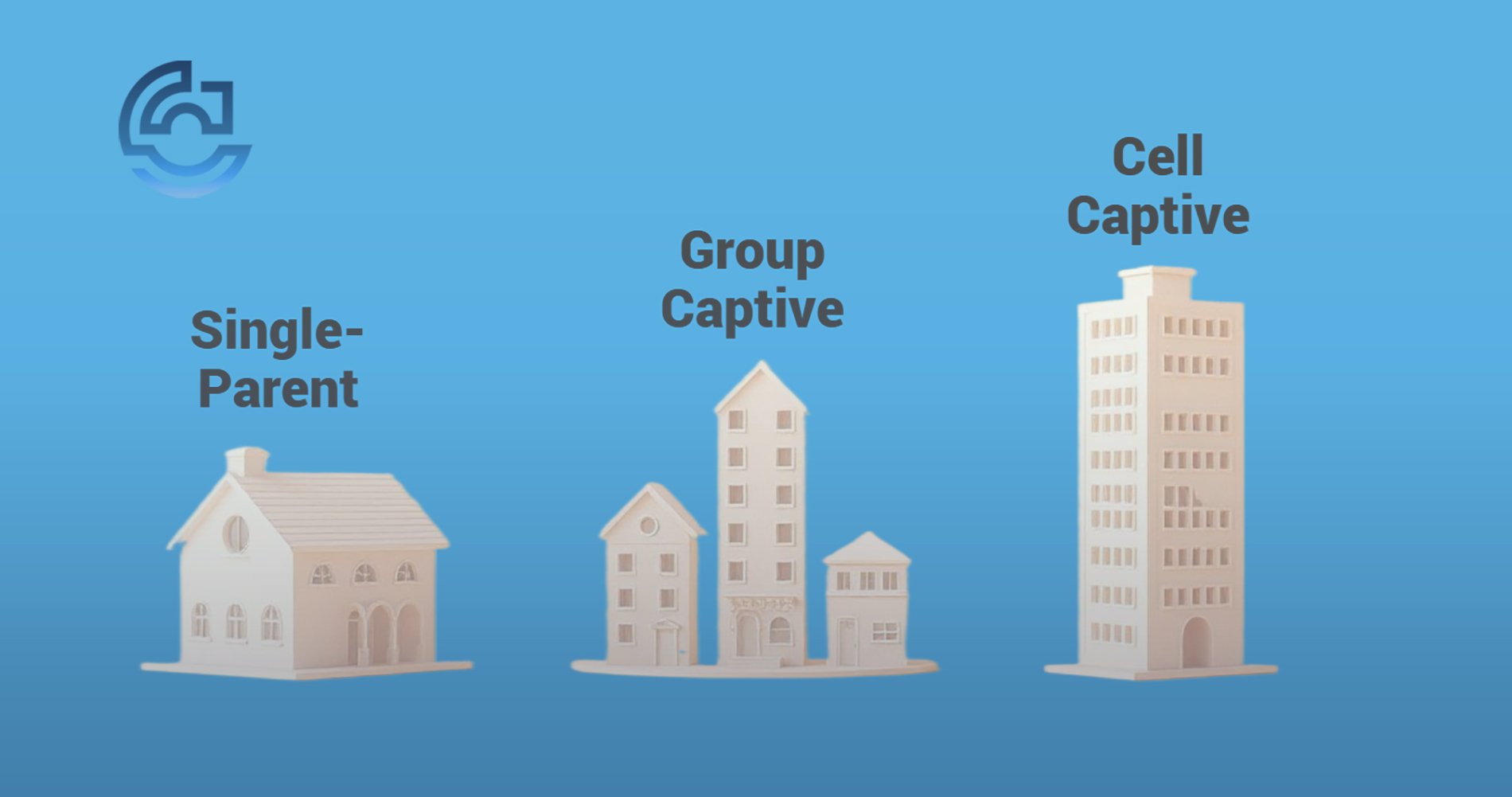

Breaking Down Captive Structures

There are three main types of captives you and your clients will run into: Single-Parent, Group, and Cell Captives.

Single-Parent Captive

This is the “build-your-own” option. One business creates its own insurance company: no sharing, no committees, and complete control.

Best for: Large businesses (spending at least $1,000,000 in annual premium) that want full autonomy and have the capital to back it up.

Take a moment to read this in-depth guide to learn more about single-parent captives.

Group Captive

Think of this like a co-op. A handful of like-minded businesses pool together to share risk, split costs, and jointly run the captive.

Best for: Mid-sized businesses that want in on captive benefits and spend at least $250,000 on premiums annually.

Take a moment to read this in-depth guide to learn more about group captives.

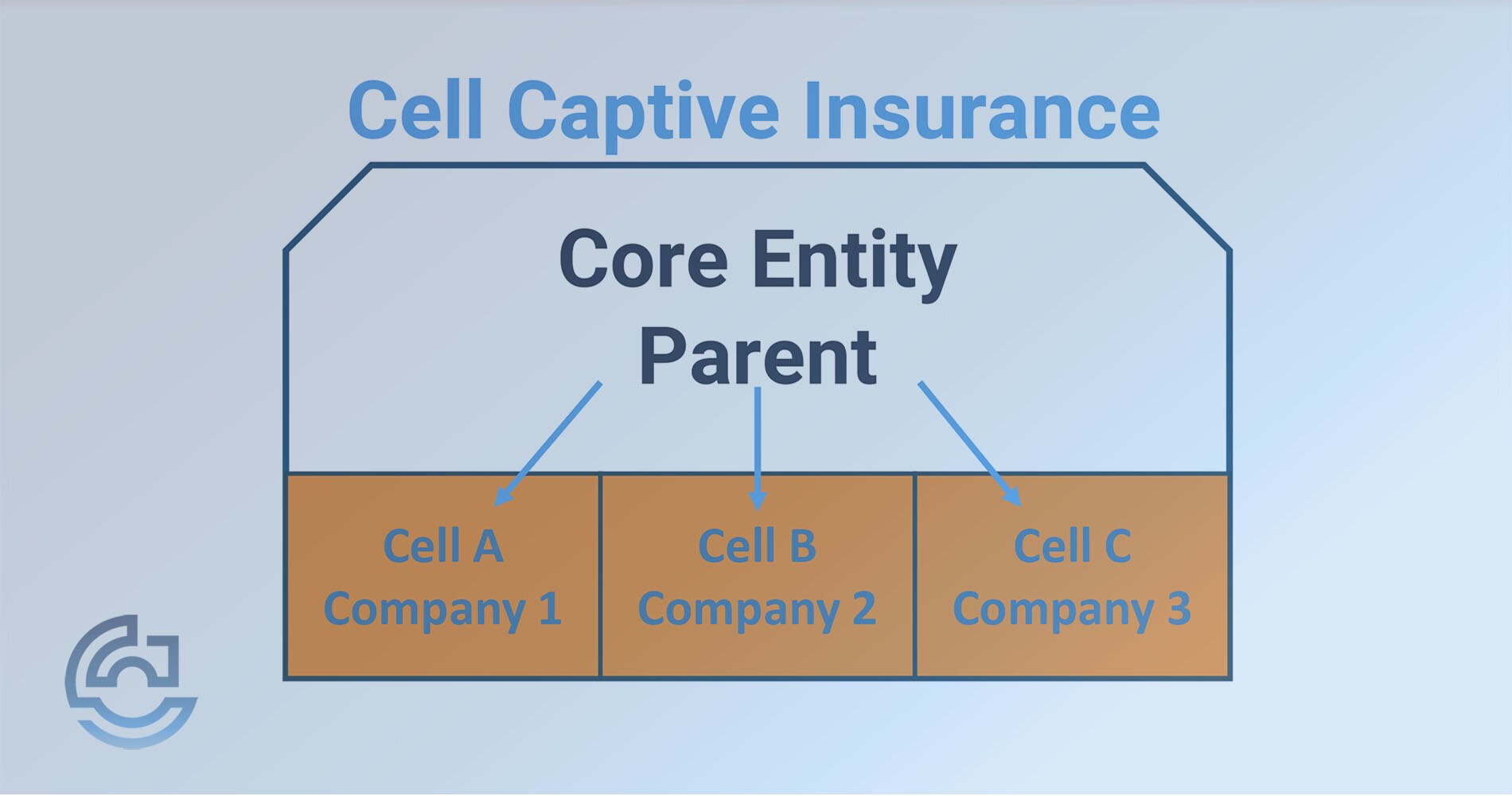

Cell Captive

Think of this like renting an office in a larger building. You control your own “cell” but share infrastructure with other businesses.

Best for: Businesses that want captive benefits without having to build or run the entire operation. Suitable for businesses spending at least $250,000+ in annual premiums.

Take a moment to read this in-depth guide to learn more about cell captives.

Side-by-Side Comparison Chart

|

Feature |

Single-Parent |

Group |

Cell |

|

Ownership |

One Business as the Single-Parent Owner |

Multiple Businesses in the captive |

Multiple Businesses in segregated cells under a parent company |

|

Control |

Parent company has full control |

Shared among other entities in the captive |

Shared within own cell |

|

Premium Customization |

Very high to align with parent company’s needs |

Moderate with coverage needing to cater to other entities |

Moderate to high coverage |

|

Cost |

High |

Lower |

Moderate |

|

Capital Requirement |

Higher upfront costs |

Moderate upfront costs |

Overall, lower upfront costs |

|

Risk Pooling |

No risk is shared among other entities |

Yes, shared among multiple entities |

Limited via Structure |

|

Regulatory Oversight |

Full Responsibility |

Shared among captive members |

Handled by Parent Captive |

|

Best Fit |

Large, capital-strong businesses |

Mid-sized, like-minded businesses |

Businesses wanting flexibility with less overhead |

Pros and Cons of Each Structure

While each structure has its benefits, they also have drawbacks for you and your clients to consider.

Single-Parent Captives

Pros:

- Total control over coverage and claims

- Customized risk management

- Retain 100% of the underwriting profit

Cons:

- Significant upfront capital

- Full responsibility for operations and compliance

- The risk isn’t shared—It belongs to the parent business

Group Captives

Pros:

- Share risk and expenses with similar businesses

- Lower capital requirement when compared to a Single-Parent

- Gain access to captive benefits without full ownership

Cons:

- Control is shared (committees, voting, etc.)

- Group dynamics matter, especially when you want good partners

- Less flexible than a Single-Parent

Cell Captives

Pros:

- Lower barrier to entry

- Control over your own “cell”

- Share overhead, not risk

Cons:

- Less control compared to a Single-Parent

- Limited flexibility compared to full ownership

- Parent captive sets some rules

How to Match Clients to the Right Captive

It boils down to:

- Capital - How much cash can they tie up?

- Control - Do they want complete control, or are they comfortable sharing?

- Risk Appetite - Are they willing to shoulder more risk for greater reward?

- Size - Bigger businesses lean toward Single-Parent Captives, while smaller to mid-sized businesses fit more with Group or Cell Captives.

Funding Mechanics: A/B Funds and Quota Share

The funding mechanics of captives can confuse clients. Heck, it can sometimes confuse agents. Don’t overcomplicate things. Here are two ways captives handle money:

A/B Fund Structure

Used mainly in Group Captives, this splits premiums into two buckets:

- A Fund - This handles smaller, more frequent claims.

- B Fund - This kicks in for big, more severe (or catastrophic) claims.

If your client controls losses well, they keep more of the money sitting in these buckets. Simple.

Quota Share

This is a risk-sharing structure. Instead of keeping all the risk, the captive passes a portion to a reinsurer.

For example, for a 50/50 quota share, the captive keeps 50% of the premium and risks while the reinsurer takes the other 50%.

Why does this matter? Quota Share lowers the capital requirement and smooths out big hits, which helps businesses new to captives ease in without taking on too much too soon.

Funding and How Money Moves in Captives

|

Funding Method |

Single-Parent |

Group |

Cell |

|

A/B Structure |

Optional funding method for single-parent |

Common funding method for group captives. |

Possible with cell captives, though less common |

|

Quota Share |

Optional for single-parent captives |

Common funding method for group captives |

Common with cell captives |

|

Purpose |

Smooth cash flow and risk management |

Spread risk among members |

Lower capital needs for cells |

|

Who Handles Funding |

The parent business |

All Captive members collectively |

Parent captive, plus each cell individually |

How Agents Can Confidently Present Captives

Most agents make the mistake of turning captives into a math lecture. Pro tip: Don’t do that.

Focus on:

- Control – Captives let your clients decide how their money is spent.

- Transparency – Your clients know where every dollar goes in a captive.

- Stability – They’re no longer at the mercy of the hard market.

Once they understand all of this, the rest becomes easy. Check out our guide on how to help your clients understand captive insurance confidently.

Are Your Clients Interested In Captive Insurers?

No one needs to make explaining captives complicated. And your clients don’t need to have a PhD in insurance. You can show them how captives are a long-term financial and insurance strategy. Single-parent, Group, or Cell, every captive has its place. The main thing is to find where they fit.

Next, read our Captive Insurance 101 Guide for Independent Agents for the captive insurance fundamentals. Or, if you don’t know if your clients are ready for captives, use our Captive Insurance Prequalification Checklist to evaluate your clients before moving forward.

To learn even more about captives, become a member of Captive Coalition for free to access tools, resources, webinars, and training to help your best clients get into captives.

Topics: